If you later receive an IRS notice later saying that you owe more taxes because you didn’t report all your income, you should immediately contact the PA Department of Labor and Industry for a corrected 1099-G. However, you do need to report the fraud to the PA Department of Labor and Industry as soon as possible. When you file your taxes, you do not have to report the income from the 1099G on your tax return. If you never applied for benefits, then you are most likely the victim of identity theft, meaning someone used your identity to claim benefits, You should report the fraud to the PA Department of Labor and Industry here. If I got a 1099G from unemployment compensation but never applied for or received any UC benefits, what do I do? If you are not a Philadelphia resident, you can find your nearest Volunteer Income Tax Assistance site using the IRS search tool.

CALCULATE 10200 UNEMPLOYMENT TAX BREAK FOR FREE

If you do not have a tax preparer, Philadelphia residents can have their taxes filed for free through the Campaign for Working Families. If you have a tax preparer, you should ask them to file an amended 2021 tax return that includes your unemployment compensation income. If you filed your 2021 taxes without including your 2021 unemployment compensation income on your federal tax return, then you will need to file an amended 2021 return with you unemployment compensation income. What if I’ve already filed my 2021 taxes, but did not include my unemployment compensation income? There is no need to delay the filing of your 2021 return if you have not already filed.

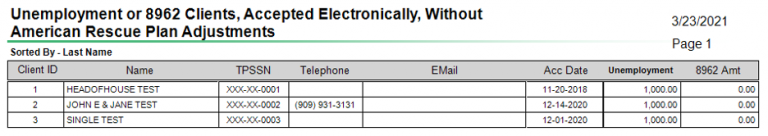

Philadelphia residents can have their taxes filed for free through the Campaign for Working Families. If you received UC, PEUC, and/or PUA payments in 2021, all of those benefits are taxable income by the IRS. Unfortunately, unlike in UC and PUA benefits from 2020, for UC and PUA benefits received in 2021, there is no tax break. You will get a 1099-G form in the mail that lists your income from UC, PEUC, PUC, and/or the Lost Wage Assistance program (the previous extra $300 per week). Yes, you do have to report your UC benefits as earned income when you file taxes. Taxes and unemployment compensation, ID theft, repayments, and other problemsĭo my UC benefits count as taxable income for 2021? A breakdown of your 1099G from Unemployment Compensation

0 kommentar(er)

0 kommentar(er)